Cash Management Solutions

Our motto is to empower businesses through innovative technology to efficiently manage, optimize and drive sustainable financial growth.

Our Cash Management solutions are specifically developed to meet the challenges treasury professionals face in today's rapidly shifting landscape. The Cash Management Solution covers the customers organization authority matrix to provide safe and secured relationship banking channel to meet EDB customers, day to day banking needs.

Scalable, Efficient, Secure, Reliable & Cost Effective

Leverage the smartest technologies for quick, convenient access to opportunities both locally or globally. We can help streamline processes, optimize returns, and automate everyday tasks to ensure cost-effective management of all your cash and working capital requirements.

EDB customer proposition will be based around the following principles:

- Efficiency: Simplify your business operations with seamless, automated banking services.

- Security: Enjoy top-tier security for all your transactions, protecting your business at every step.

- Flexibility: Customizable solutions that evolve with your business needs, whether you're a startup or an established enterprise.

- Dedicated Support: Our Cash Management team is always here to assist you, offering personalized guidance and support for your business growth.

Account Services: Simplify your banking with our wide range of account options and services:

- A complete overview of your banking relationship with EDB.

- Complete Dashboard depicting your banking relationship with EDB, covering all Account, Deposits and Loans with EDB.

- A complete view of your Asset and Liability position with the Bank.

- Additional Current Account: Open an additional AED/ USD account in minutes through EDB SmartConnect

- Call Account: Earn competitive interest on idle funds with easy access to your money whenever you need it.

- Fixed Deposit Account: Secure and grow your funds with a fixed deposit, offering attractive interest rates and flexible term options.

- Virtual Accounts: Manage multiple transactions seamlessly by creating virtual sub-accounts linked to a single main account.

- Liquidity Management Sweeps: Optimize your cash flow by automatically sweeping

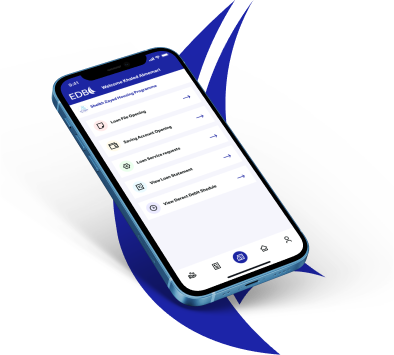

Payments: Secure and automated transfers, Enjoy the convenience of quick and easy money transfer through secured and user-friendly online channels such as – EDB Smart Connect web portal and EDB smart connect mobile App.

FCY Payments: Make seamless international payments in various currencies with competitive exchange rates and low processing fees.

Bulk Payments: Simplify non-wps payroll and vendor payments with automated bulk payment processing, saving time and reducing errors, with universal adaptor capabilities.

Future Dated Payments: Schedule payments for future dates to ensure timely transactions, providing better cash flow management.

Wages Protection System (WPS): Process Salary payments for all your employees, direct to their account or salary cards.

GPSSA Pension Payments: Process pension payments to GPSSA securely and on time.

Host-to-Host (H2H): Automate and integrate your payment systems with ours for faster, error-free transactions, with Universal Adaptor capabilities.

Bill Payments: Pay your company Utility bills, Telecom and others efficiently, saving time and ensuring timely settlement.

Corporate Cards: Diligently manage your corporate expenses using corporate cards issued by our third-party partner.

Intrabank transfers: Within EDB Transfers, customers can initiate quick payments within their own EDB accounts or to an account holder within the EDB network.

Domestic transfers: Well-suited for transfers within the UAE, all payments are settled through the UAE Fund Transfer System (UAEFTS). Transactions are routed through the Central Bank and received by the beneficiary bank for credit to the end beneficiary. Domestic Transfers are fast, secure and reliable under a Central Bank facilitated and regulated system.

Cross border transfers: Make payments to bank accounts across the world with your EDB Account. All cross-border transfers are facilitated through a SWIFT network, with the ability to reconcile and track the status of transfers.

Packed with features like: Payments can be made as single, basket or uploaded as a file, in the bank's specified format. The file upload supports bulk payments to suppliers and vendors across the globe. Online validation of the SWIFT, IBAN and SORT codes Take advantage of future dated and special deal payments Download SWIFT copies and acknowledgements from the online channel for payment confirmations Create payment templates once and save for future use Send beneficiary email advice with invoice.

Deposits: A Fixed Term Deposit account is available in AED and USD, and you can save for a set period that you choose.

- Choose a fixed term between 1 month and 12 months (some currency terms may vary)

- For USD, GBP and EUR, (please call your Relationship Manager for more information)

- Hassle-free reinvestment - your term will automatically renew unless you tell us otherwise.

Statements & Reports: Get all statements and advice for your relationship with EDB.

- Account Statement

- Loan Statement

- Transaction History

- Debit Advice

Limits and Loans: Summary/overview and loan Schedule Complete Loan overview, with the following details:

- Loan Start Date

- Maturity Date

- Interest rate

- Principal Amount

- Interest Amount

- Currency

- Outstanding balance

- Overdue Status/ Amount

- Next Due Date/ Amount

Collections: Optimize your collection processes with reliable solutions:

Cash Collections: Secure and efficient cash collection services tailored to your business needs.

Cheque Collections: Fast and safe collection of cheques to minimize processing delays.

Cheque Scanning: Enhance cheque scanning and processing, improving speed and accuracy from corporate customers office.

Direct Debit Authority: Set up DDA instructions, reducing manual intervention and ensuring on-time collections.

Payment Gateway: Accept online payments easily with our secure and integrated payment gateway solutions, offering multiple payment options for your customers.

To apply for our cash management solutions, please click here.

For any inquiries fill out the application form here, and we'll get back to you. Alternatively, you can reach out to us directly at 800-272-74

Click here for more information.

- Corporate Banking Services - Pricing Guide

- Cash Management Services - Terms and Conditions

Empowering your business when you need it most

From account set up to financing business needs

Get in touch now