A mission that moves a nation

EDB is the key financial engine for diversified and sustainable economic growth in the UAE. We're driven to match the ambitions and inspire businesses in key sectors and of all sizes through financial and non financial support, creating economic success that lasts.

Developing a dream

A pioneering and forward-thinking nation never stands still. As a beacon of ambition throughout the world, The UAE established Emirates Development Bank (EDB) to chart a more sustainable path to economic success, an economy that is healthy, sustainable, and self-reliant. To achieve this, we identified five key priority sectors to develop - advanced technology, food security, healthcare, manufacturing, and renewables.

A bank with a different drive

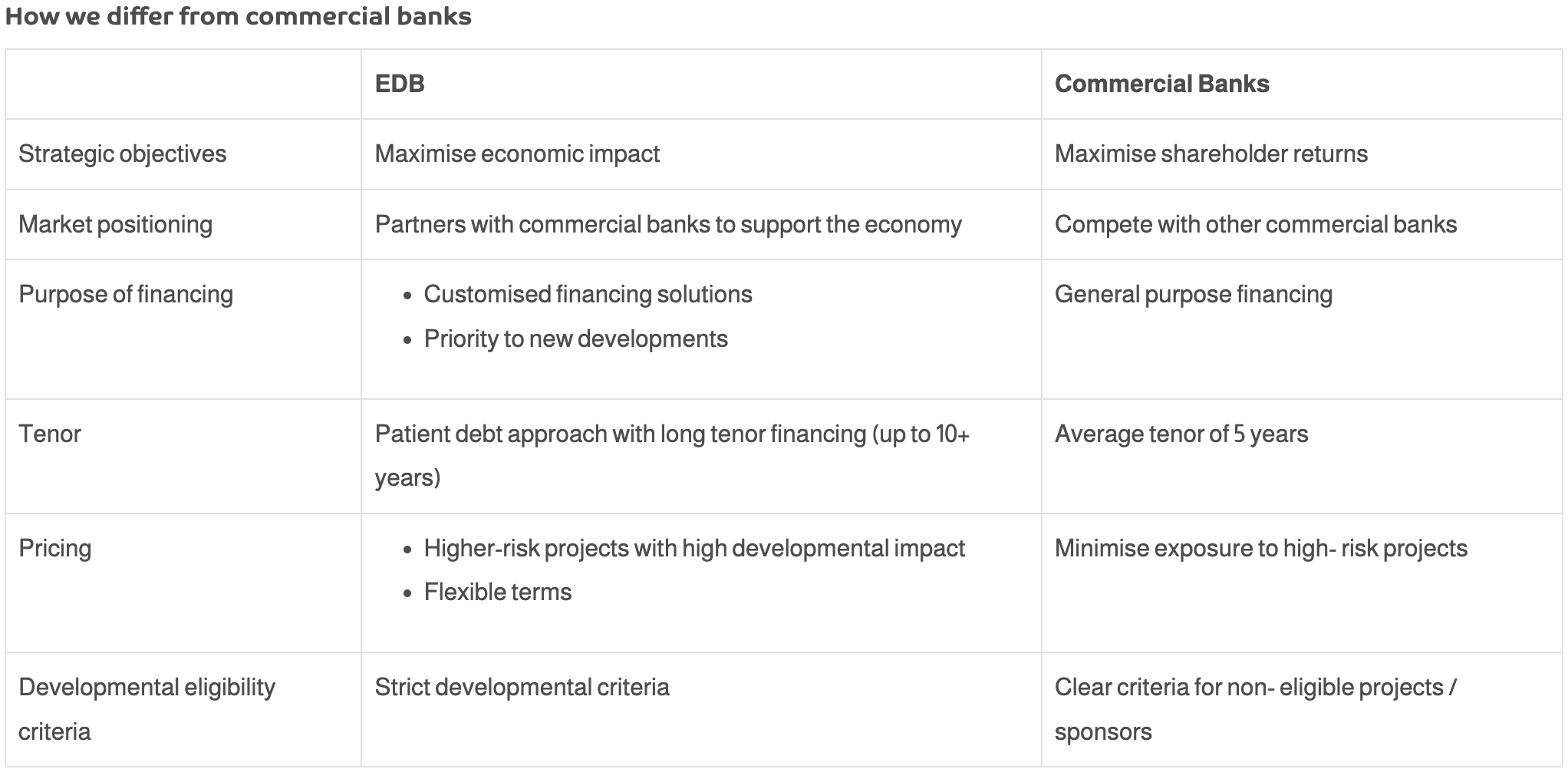

We aren't like commercial banks. Our drive is not around profit. Instead our purpose is to drive sustainable growth in every size business across key industries in the UAE. Our role and our mission mean what we offer businesses is also different. We go beyond short sighted and one sided lending. Because we're here to develop, our services are created to put business development first.

- We make our financing decisions based on sustainable impact and self-reliance for the UAE economy rather than profit.

- If you need a longer term horizon, we can offer you 'patient debt' rather than the standard 5 years.

- In addition to direct financing, we also offer indirect financing solutions to SMEs by guaranteeing commercial loans.

- We offer business banking to startups who may not qualify for regular banking services.

- Our business banking offers tailored features for startups and SMEs that they can't get elsewhere.

- We go beyond finance by offering tailored education, mentoring programs and innovation labs creating a thriving startup ecosystem.

Every financial solution we offer is designed to support businesses, meaning we have very different conversations with our clients compared to a commercial bank. Why? Because your goal is our goal. We're a bank with a different drive.

We know our business

By understanding the intricacies of our five strategic sectors, we're able to carefully create financing conditions and develop educational growth tools for businesses and projects addressing the key opportunities and challenges within each sector.

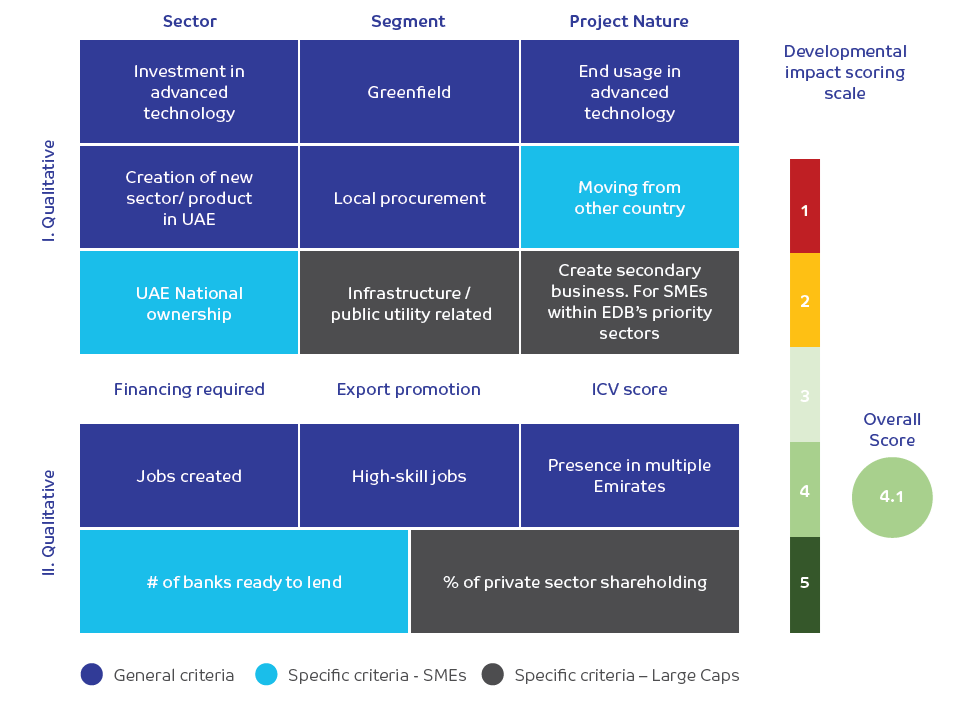

Our knowledge and experience means we make lending decisions based on a scorecard that measure developmental impact. This ensures that the businesses and projects we partner with have a maximum impact on the development of the UAE economy.

Our dedication to growing business can be seen in the variety of products made to serve businesses at every stage of their life cycle, from start-ups and SMEs to large corporations, we're here to support every step of the way.

EDB sets itself apart by filling critical lending gaps in the UAE through its willingness to lend to economically strategic projects. Given its developmental mandate, EDB offers patient debt and favourable financing terms to our clients.

Our Strategy

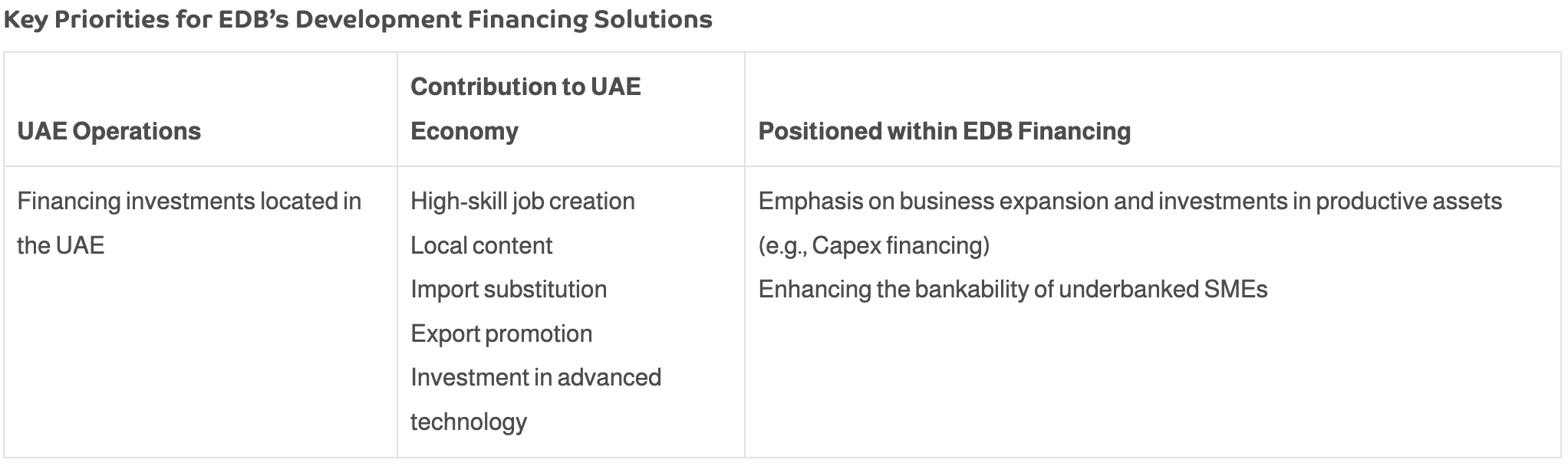

Key Priorities for EDB's Development Financing Solutions

How we differ from commercial banks

EDB’s Development Impact Scorecard

At EDB, as part of the assessment process, every loan is evaluated through the Bank’s proprietary ‘Development Impact Scorecard.’ The tool measures more than 20 quantitative and qualitative factors regarding each loan’s potential impact on economic development.

Empowering your business when you need it most

From account set up to financing business needs

Get in touch now