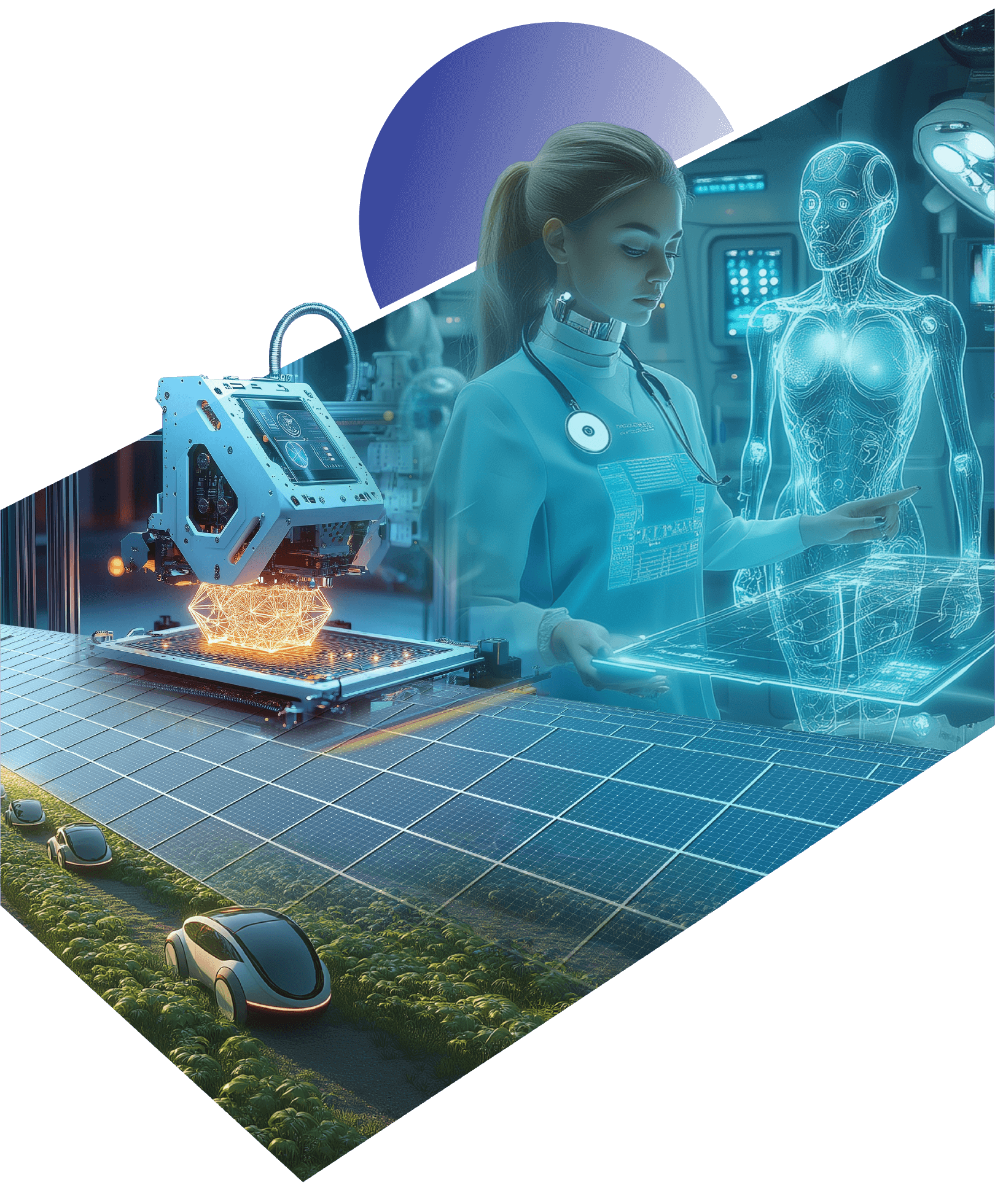

As the UAE continues its sustainable industrial growth, Emirates Development Bank plays a vital role in turning ambition into action — enabling businesses to scale, sectors to thrive, and the nation to lead.

Read more

Every initiative EDB drives is anchored to four national priorities:

Through focused financing, ecosystem-building, and non-financial support, we direct our energy and expertise into five strategic sectors — the pillars of the UAE’s next economic chapter:

Since launching its new strategy in April 2021, EDB has delivered measurable national impact — driving industrial growth, enabling private-sector expansion, and contributing to the UAE’s economic transformation.

2024 saw EDB increase their partnerships with the following:

At EDB, micro, small, and medium enterprises (mSMEs) are recognised as the engine of national economic growth — driving innovation, creating jobs, and strengthening supply chains across the UAE. In 2024, the division delivered a strong year of performance, advancing EDB’s strategy to broaden access to finance, simplify pathways for entrepreneurs, and build strategic partnerships across the banking ecosystem.

Read more

TEDB’s Wholesale & Institutional Banking (WIB) division connects large corporates, industrial champions, and key institutions with the financing they need to scale, with a focus on the sectors and enterprises critical to the UAE’s long-term resilience and global competitiveness.

Read more

In 2024, EDB’s Treasury and Investments (T&I) division played a critical role in sustaining the Bank’s strong financial position while enabling long-term growth. By managing liquidity, optimising investments, and diversifying funding sources, T&I strengthened EDB’s ability to deliver impact while navigating an evolving financial landscape.

Read more

At EDB, operational excellence and technological strength are the foundations that enable the Bank to deliver on its national mission. In 2024, the Operations & IT teams worked behind the scenes — yet at the very heart of progress — driving system upgrades, platform launches, cybersecurity enhancements, and infrastructure growth that allowed the Bank to scale, innovate, and serve the UAE’s evolving needs.

Read more

Behind every financing milestone, sectoral breakthrough, or strategic partnership at EDB, there is a team of people making it happen. The Support Functions – led by the Human Resources team – play a critical role in building and sustaining the organisational strength that enables the Bank to deliver on its mandate.

Read more